Q2 FY25 Highlights: Adding Value, Enhancing Efficiency and Effectiveness

March 11, 2025 5 minute read

Thanks to UNFI associates’ hard work and dedication, the company again delivered steadily improving second quarter financial results while continuing to execute its long-term growth strategy.

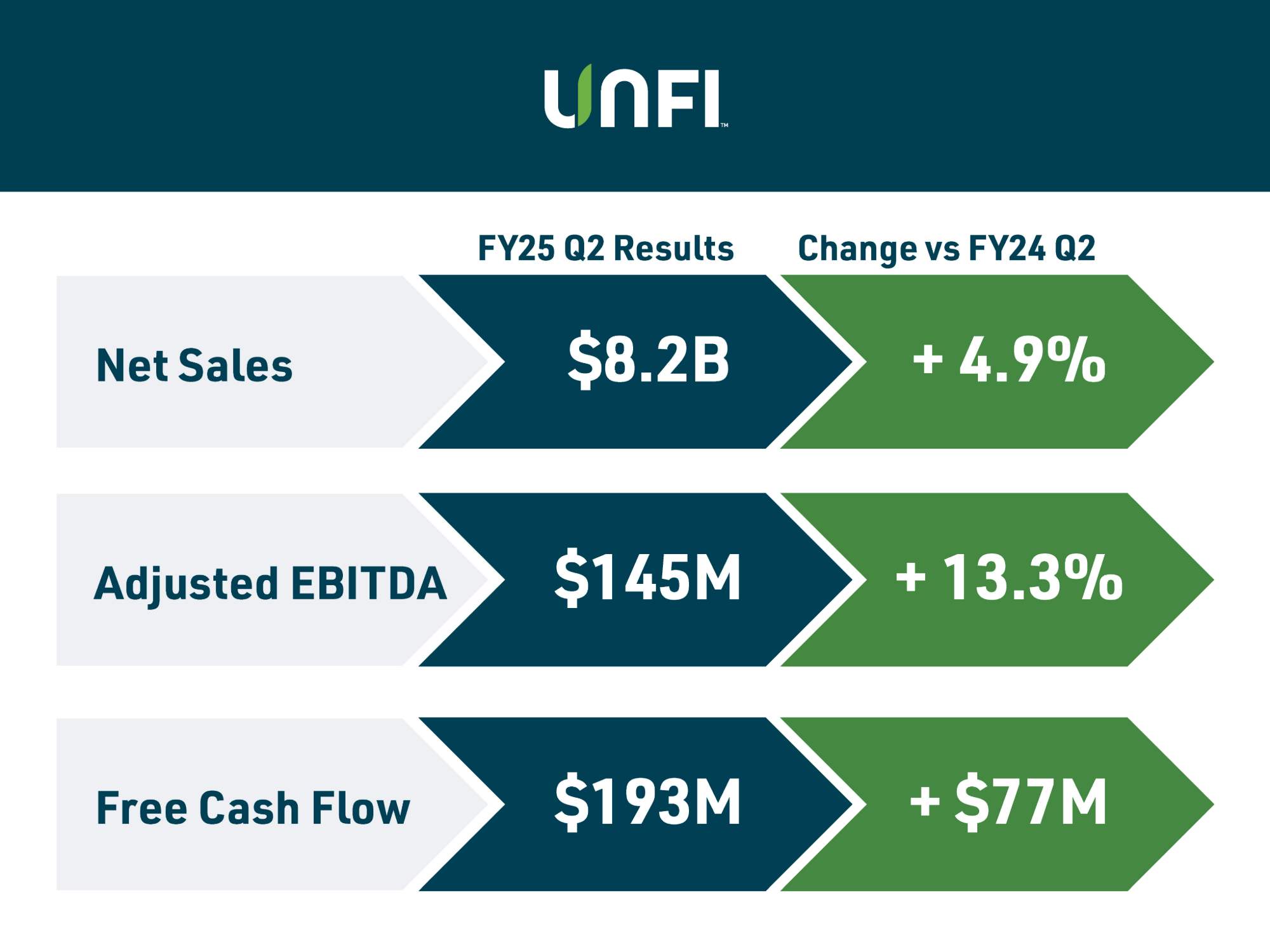

Financial highlights include:

Net sales growth of nearly 5%

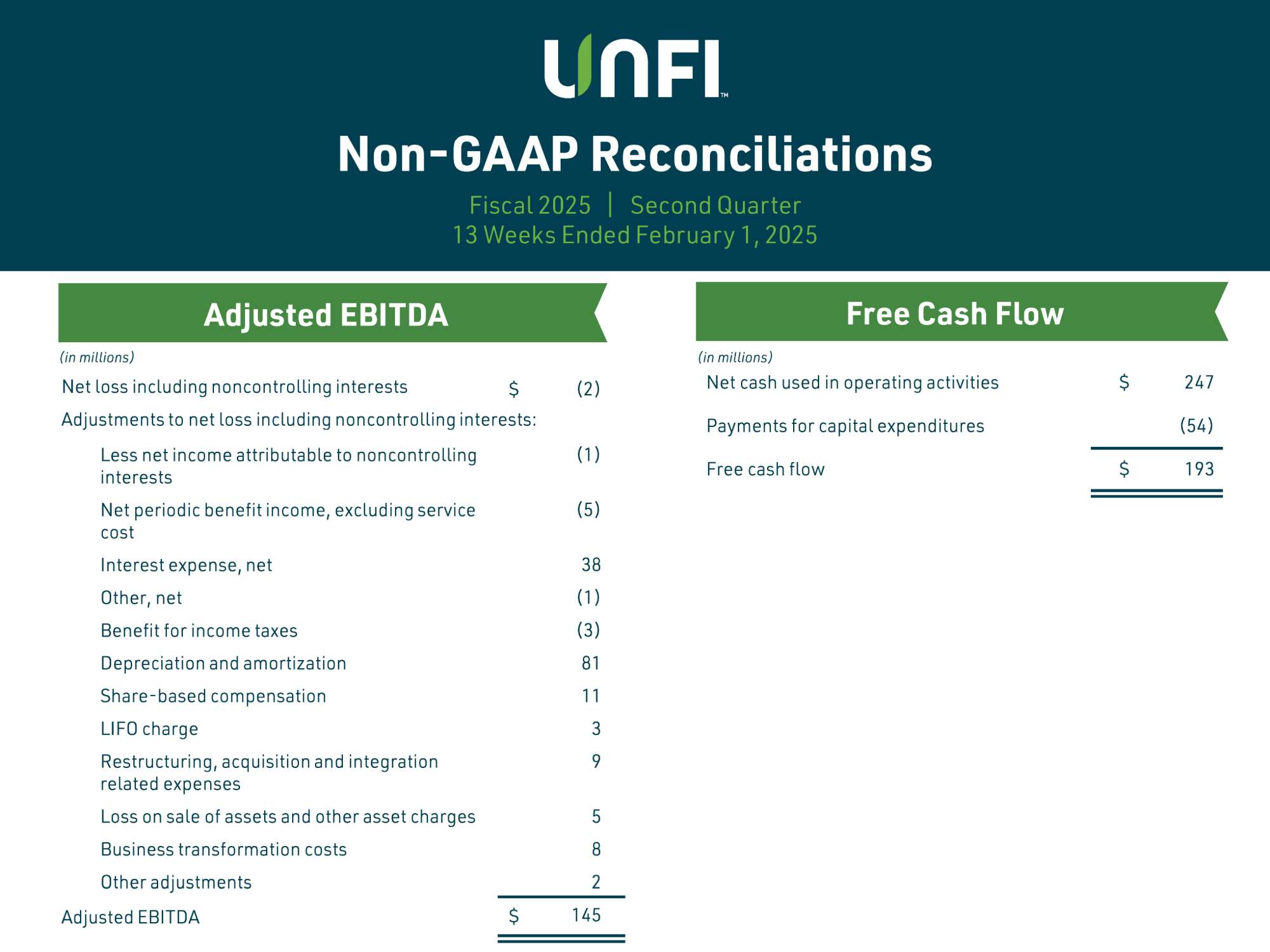

Sixth consecutive quarter of adjusted EBITDA growth (+13%)

Free cash flow of $193 million (+$77 million)

“These results reflect the continued execution of UNFI’s strategy, which is centered on adding more value for customers and suppliers, and becoming a more effective and efficient organization,” said Sandy Douglas, UNFI CEO. “Our increased outlook reflects our year-to-date performance and growing level of confidence in our business model and customer base.”

Adding Value for Customers and Suppliers

In Q2, UNFI continued seeking opportunities to create more value for customers and suppliers. Notably, this quarter the company began the process of realigning its wholesale structure to help its partners achieve their unique growth strategies by creating two product-centered divisions, Conventional Grocery Products and Natural, Organic, Specialty & Fresh Products.

This new model aligns UNFI’s sales teams to the unique product and service needs of its customers, with specialized support across merchandising, operations, procurement, and supplier services. With this structure, UNFI is better positioned to provide the highly customized and responsive support retailers and suppliers need to be successful.

UNFI saw sales growth in both the natural products division (+8%) and the conventional products division (+2%), including improving overall unit volumes (+3%) that outpaced industry benchmarks.

These positive trends point to the strength of UNFI’s customer base and the unique role the company plays in the food distribution supply chain.

Improving Efficiency and Effectiveness

In Q2, UNFI also made progress toward becoming a more efficient and effective business.

The company continued to optimize its distribution center (DC) network through investments in technology and targeted consolidation of select DCs into more modern, nearby facilities with broader product assortments and enhanced technologies. Each of these initiatives has helped UNFI improve service levels and reinvest in new facilities like Manchester, PA.

UNFI has expanded the Lean daily management process into nine DCs year to date. UNFI President and Chief Financial Officer Matteo Tarditi said, “Lean is empowering our warehouse associates to see potential problems and immediately deploy resources to solve them. Early results are leading to improvements in safety, fulfillment, on-time deliveries, and labor productivity.”

The UNFI team’s disciplined focus on driving efficiency and effectiveness helped generate $193 million in free cash flow in Q2. This accelerated free cash flow generation is allowing the company to reduce leverage and strategically reinvest for the future.

Looking toward the second half of fiscal year 2025, UNFI has raised its full year financial outlook for most key metrics, including net sales, adjusted EBITDA, and free cash flow.

Douglas concluded, “As we implement our strategy, we’ve continued to gain additional insight and believe the opportunity before us is greater than the progress behind us. To capture this opportunity, we know we must stay focused and strive to get better every day – and we’re committed to doing just that.”

For more details, read UNFI’s FY25 Q2 press release here, or listen to a recording of its public earnings call here.